Get a list of homes close to dog parks and services

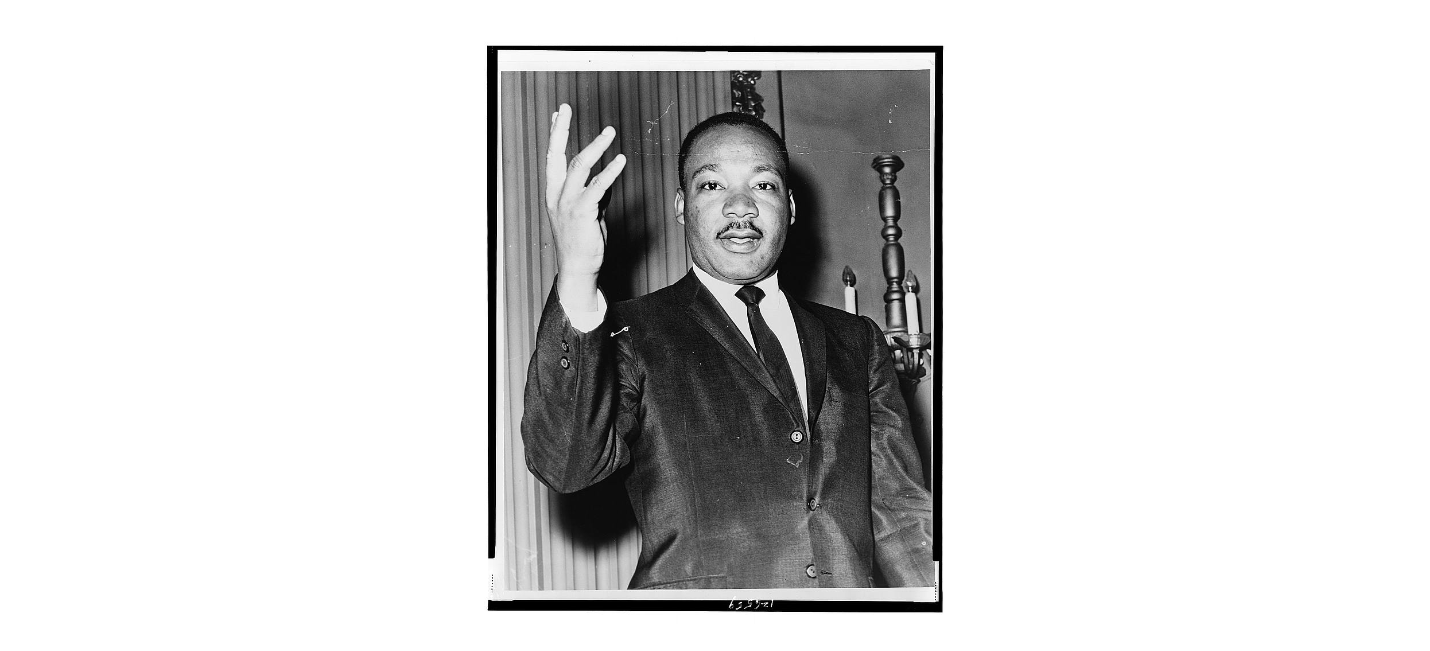

Honoring Dr. Martin Luther King Jr.

Every year on MLK Day, we pause to honor Dr. Martin Luther King Jr.—a leader whose vision for equality reshaped every corner of American life. One of the most profound and lasting impacts of the Civil Rights Movement is on housing. The way we buy, sell, rent, and own homes today is directly tied to the fight for civil rights.

For real estate professionals, this day is more than a moment of reflection—it’s a reminder that our industry exists on a foundation built by those who demanded fairness, dignity, and equal opportunity.

🏡 Before Civil Rights: Housing Was Not Equal

Prior to the Civil Rights Movement, discriminatory practices were widespread:

• Redlining

• Racial covenants

• Denial of loans based on race

• Segregated neighborhoods

• Unequal access to property ownership

These practices weren’t just social norms—they were often legal and deeply embedded in the real estate system.

✊ The Civil Rights Act of 1866: The First Step Toward Fair Housing

The Civil Rights Act of 1866 was the first federal law to guarantee that all citizens—regardless of race—had the same rights to inherit, purchase, lease, sell, hold, and convey property.

Although groundbreaking, it wasn’t strongly enforced for nearly a century. Still, it laid the legal foundation for everything that came later.

🏛️ The Civil Rights Movement → The Fair Housing Act of 1968

Dr. King’s leadership and the national demand for equality pushed housing discrimination into the spotlight. After his assassination, Congress passed the Fair Housing Act of 1968, a defining moment in real estate history.

This law made it illegal to discriminate in housing based on:

• Race

• Color

• National origin

• Religion

Later amendments added protections for sex, disability, and familial status.

The Fair Housing Act fundamentally changed the real estate industry by:

• Ending legal segregation in housing

• Opening mortgage access to minority buyers

• Requiring equal treatment in advertising, lending, and sales

• Creating accountability for discriminatory practices

• Establishing fair housing enforcement mechanisms

🌆 How Civil Rights Shaped Modern Real Estate

Today’s real estate landscape—especially in diverse communities like South Jersey—is a direct result of the Civil Rights Movement’s victories.

1. Equal Access to Homeownership

Minority families gained the legal right to buy in any neighborhood, pursue financing, and build generational wealth.

2. Professional Standards for Agents

Fair housing compliance is now a core part of licensing, ethics, and daily practice for every real estate agent.

3. Diverse, Inclusive Communities

Urban development and community planning shifted toward more equitable access and opportunity, influenced by civil rights reforms.

4. Economic Empowerment

Stories like Bernard Garrett—who built a real estate empire despite Jim Crow barriers—highlight how civil rights opened doors for minority entrepreneurs in real estate and banking.

🕊️ Why MLK Day Matters in Real Estate

Dr. King believed that fair housing was essential to achieving true equality. Access to a safe home, a good neighborhood, and the chance to build wealth is a cornerstone of the American Dream.

As real estate professionals, we carry that legacy forward every time we:

• Treat every client with fairness

• Advocate for equal access

• Educate buyers and sellers

• Promote diverse, thriving communities

MLK Day is a reminder that our work is part of something bigger—helping families find a place where they can grow, thrive, and build a future.

✨ Closing Thought

The Civil Rights Movement didn’t just change laws—it changed lives. It reshaped the real estate industry into one that strives for fairness, opportunity, and dignity for all. As we honor Dr. King today, we also recommit ourselves to upholding the values that make homeownership accessible and equitable.

🏡 Resale vs. New Construction: What South Jersey Buyers Should Know

In today’s South Jersey real estate market, buyers are weighing two major options: purchasing a resale home or investing in new construction. Each path offers distinct advantages—and trade-offs—that can impact your budget, timeline, and long-term satisfaction. Let’s break down the pros and cons of both, with a local lens on what’s happening across Camden, Gloucester, Atlantic, and Cape May counties.

🔨 New Construction: Fresh, Incentivized, but Slower

Pros:

- Developer Incentives: Many builders in South Jersey are offering special interest rate buydowns, closing cost assistance, and appliance packages to attract buyers. These perks can significantly reduce upfront costs.

- Customization: Buyers often get to choose finishes, layouts, and upgrades to suit their taste.

- Energy Efficiency: New homes typically feature better insulation, smart systems, and modern HVAC setups, which can lower utility bills.

- Warranty Coverage: Most new builds come with structural and systems warranties, offering peace of mind.

Cons:

- Longer Wait Times: Build timelines can stretch from 6–12 months, especially in high-demand areas like Woolwich, Sicklerville, and Egg Harbor Township.

- Higher Property Taxes: New construction is assessed at full market value, often resulting in higher annual tax bills compared to resale homes.

- Limited Inventory: Some developments have waitlists or limited lot availability, making it harder to secure a unit quickly.

-

🏠 Resale Homes: Faster, Potentially Cheaper, but Competitive

Pros:

- Immediate Move-In: Resale homes are ready now—ideal for buyers who need to relocate quickly or want to lock in a rate before market changes.

- Lower Taxes: Older homes often have lower assessed values, which can mean thousands in annual savings.

- Established Neighborhoods: Mature landscaping, settled communities, and known school zones can be a big draw.

Cons:

- Bidding Wars: Inventory remains tight in South Jersey, especially under $350K. Resale homes often attract multiple offers, driving prices above asking.

- Maintenance Costs: Older systems and finishes may require updates or repairs sooner than a new build.

- Less Customization: What you see is what you get—unless you’re ready to renovate.

-

💡 Final Thoughts

If you’re looking for a turnkey home with predictable taxes and a fast move-in, resale might be your best bet. But if you’re drawn to modern features and builder incentives—and can wait for the right lot—new construction offers long-term value.

In South Jersey’s dynamic market, the right choice depends on your timeline, budget, and lifestyle goals. Whether you’re eyeing a townhome in Ventnor or a single-family build in Egg Harbor Township, understanding these trade-offs will help you make a confident decision.

Ready to find out more?

Drop us a line today for a free quote!

Is Buying a Home Better Than Renting?

The average cost to rent a 3 bedroom Home in New Jersey is $3,000

If you are currently paying $3,000 per month in rent, you are already proving you can handle a significant monthly housing cost. In today's market (as of early 2026), that same $3,000 monthly budget could potentially afford you a home priced at approximately $480,000.

How the Numbers Break Down

When you transition from renting to buying, your $3,000 "all-in" payment is typically split into four categories:

-

Principal & Interest: The core of your mortgage payment.

-

Property Taxes: Essential for local services (estimated for NJ).

-

Homeowners Insurance: Protecting your investment.

-

PMI (Private Mortgage Insurance): Usually required if your down payment is less than 20%.

The Hidden Financial Benefit

While rent is a 100% expense that goes to your landlord, a mortgage payment acts as a forced savings plan.

-

Equity Building: A portion of every $3,000 payment goes toward your principal balance, building your net worth.

-

Tax Advantages: You may be eligible for tax benefits that renters don't receive.

-

Fixed Costs: While rents tend to increase by 2–4% annually, a fixed-rate mortgage keeps your principal and interest the same for 30 years.

Buy for 3,000/mo.

- Own a home worth approximately 480,000

- Build equity every single month

- Lock in your housing cost for 30 years

- Potential tax interest deductions

Find Out Exactly What You Can Afford

Get a personalized mortgage breakdown and see what kinds of programs that can help 1st time buyers.

Couple preparing to buy a property.

Navigating Today’s Real Estate Market: Your Guide to Buying a Home.

The journey to homeownership is exciting, but it can also feel overwhelming, especially with headlines constantly shifting. If you’re considering buying a home, you’re likely wondering: Is now a good time? Can I afford it? Where do I even begin?

Don’t let uncertainty delay your dreams. With the right strategy and a trusted local expert by your side, securing your ideal home is absolutely within reach. This guide will cut through the noise and equip you with the knowledge to buy your next home confidently.

Understanding the Current Market: What Buyers Need to Know

Today’s real estate market often feels complex. We’re seeing fluctuating interest rates, evolving inventory, and varying price trends depending on your specific location. While some markets are still competitive, others are offering more opportunities for buyers.

Key things to consider:

-

Interest Rates: Stay informed, but don’t obsess. Even small rate changes can impact affordability, so understanding your budget with different scenarios is crucial. Remember, a good home at a slightly higher rate can still be a better long-term investment than waiting indefinitely.

-

Inventory: Some areas are seeing increased inventory, giving buyers more choices and potentially reducing bidding wars. Other desirable neighborhoods may still have limited options, requiring quicker decisions.

-

Home Prices: While a general trend might be reported, real estate is hyper-local. What’s happening in one town can be very different from the next.

The most important takeaway? Local market knowledge is your most powerful tool.

Your Pre-Purchase Checklist: Getting Ready to Buy

Preparation is key to a smooth and successful home-buying experience. Here’s a checklist to get you started:

-

Assess Your Finances:

-

Budgeting: Clearly define what you can realistically afford for a monthly mortgage payment, including property taxes, insurance, and potential HOA fees.

-

Savings: Ensure you have enough saved for your down payment and closing costs.

-

Credit Score: Check and improve your credit score if needed, as this significantly impacts your interest rate.

-

-

Get Pre-Approved, Not Just Pre-Qualified: A pre-approval from a lender demonstrates your serious buying intent and tells sellers you’re a qualified buyer. This is a critical step before you even start looking.

-

Define Your Must-Haves & Nice-to-Haves: Create a clear list of what you absolutely need in a home (e.g., number of bedrooms, specific school district) versus what you’d love to have (e.g., updated kitchen, large yard). This helps narrow your search.

-

Research Neighborhoods: Look beyond the house itself. Consider commute times, local amenities, school ratings, and future development plans in neighborhoods you’re interested in.

Why Partnering with a Local Real Estate Expert is Non-Negotiable

Navigating the nuances of local real estate trends, negotiating offers, and understanding complex contracts can be daunting. This is where a seasoned real estate agent, especially one deeply familiar with your target area, becomes invaluable.

A local expert can:

-

Provide Hyper-Local Market Insights: They know the micro-trends that national reports miss – which streets are hot, upcoming developments, and true neighborhood values.

-

Identify Off-Market Opportunities: Sometimes, the best homes aren’t publicly listed yet. A well-connected agent can give you an edge.

-

Negotiate Effectively: From crafting competitive offers to handling counter-offers and inspection requests, their negotiation skills can save you time and money.

-

Streamline the Process: They connect you with trusted lenders, inspectors, and other professionals, making your journey seamless.

Don’t leave your biggest investment to chance.

Ready to Find Your Dream Home?

Whether you’re a first-time homebuyer feeling overwhelmed or an experienced homeowner looking to relocate to a new neighborhood, now is the time to turn your aspirations into reality.

I’m Jacob Ely, your dedicated local real estate expert, and I’m here to guide you through every step of the process. From understanding current mortgage rates to discovering hidden gems in Ventnor City, NJ, or the surrounding South Jersey real estate market, my goal is to make your home buying experience successful and stress-free.

Let’s connect and discuss your home-buying goals today!

Young couple

Buying a home in today’s economy is challenging—but not impossible. With smart planning, disciplined saving, and strategic timing, you can position yourself to purchase confidently and sustainably.

🏡 How to Save and Prepare to Buy a Home in This Economy

The housing market is still competitive, interest rates remain elevated, and inflation continues to impact everyday expenses. But if homeownership is your goal, here’s how to make it happen—even in 2025.

💰 1. Know Your Numbers First

Before you start saving, understand what you’re aiming for:

- Down payment: Typically 3%–20% of the home price. A $300,000 home might require $9,000–$60,000.

- Closing costs: Usually 2%–5% of the purchase price.

- Monthly affordability: Use mortgage calculators to estimate payments based on current rates (around 6.8% for a 30-year fixed).

📊 2. Build a Budget That Works

- Track your spending: Use apps or spreadsheets to monitor income and expenses.

- Cut non-essentials: Pause subscriptions, reduce dining out, and renegotiate bills.

- Automate savings: Set up recurring transfers to a high-yield savings account dedicated to your home fund.

🏦 3. Choose the Right Savings Vehicle

- High-yield savings accounts: Safe and accessible, ideal for short-term goals.

- Certificates of deposit (CDs): Lock in higher interest rates for fixed periods.

- Money market accounts: Offer better returns with check-writing flexibility.

🧠 4. Improve Your Credit Score

A better credit score means better mortgage rates:

- Pay bills on time

- Keep credit utilization below 30%

- Avoid opening new credit lines before applying for a mortgage

🏘️ 5. Explore Loan Options

- FHA loans: Require lower down payments (as low as 3.5%) and are great for first-time buyers.

- VA loans: No down payment for eligible veterans.

- Conventional loans: Offer flexibility but require stronger credit and higher down payments.

📉 6. Time Your Market Entry

- Watch interest rate trends: Even a 0.5% drop can save thousands over the life of a loan.

- Monitor local inventory: More listings can mean better deals.

- Consider seasonal timing: Winter months often bring less competition and motivated sellers.

🧭 7. Get Pre-Approved Early

A mortgage pre-approval:

- Shows sellers you’re serious

- Helps you understand your budget

- Locks in a rate for up to 90 days

🛠️ 8. Prepare for Hidden Costs

- Home inspection fees

- Appraisal fees

- Moving expenses

- Initial repairs and furnishings

🧩 Final Thought

In this economy, buying a home requires more than just saving—it demands strategy. Whether you’re a first-time buyer or an investor looking to expand, the key is preparation. If you’re ready to explore properties in Atlantic City or South Jersey, I can help you find homes that match your budget and long-term goals.

Let’s turn your savings into a smart investment. Reach out today to start your homeownership journey

🏡 Ready to Start Your Homeownership Journey?

In this economy, buying a home requires more than just saving—it demands strategy. Don’t go it alone! Reach out today to schedule a free, no-obligation consultation. As a South Jersey expert, I can help you find a home that matches your budget and long-term goals.

Click here to contact Jacob Ely and start your Search today!